Home

- Seed, anchor and growth capital

- Corporate executive connectivity

- Investment officer networks

- Institutional sponsorship for financial positioning and track records

- Customer acquisition

Our Philosophy

The 1921 Fellowship is comprised of diverse industry executives within global fund management, academia, tech and innovation, real estate, and corporate and financial markets, to actively cultivate a platform for success amongst Black fund managers and founders by:

Bridging the investment and human capital divide.

We provide intentional access to mission-aligned, vetted sources of capital, allocator networks, technological expertise, research and legal insights, and comprehensive business development talent.

Convening investment capital and building connectivity.

Influential relationships are invaluable to all fund managers, and a necessity to the success of the emerging fund manager. The network around the asset allocators, though, appears impenetrable to the emerging Black manager with no effective connection into the established frameworks. The Institute has accelerated the connectivity by uniting leaders from renowned financial institutions with Black fund managers to enhance the breadth and diversity of investment allocations.

Building high-impact infrastructures.

We position under-represented managers to receive more “anchor” capital and leverage financial markets, all to generate high-growth in economic sectors. The injection of diversified institutional and human capital, traditional venture capital, growth equity and corporate investment increases infrastructure to create and fund vehicles that support under-represented founders.

Modeling economic and entrepreneurial growth.

We partner with academic institutions and financial organizations, to design innovative programs and finance initiatives that embed value creation strategies to transfer to the next generation of entrepreneurs and fund managers.

Our Visionaries

Paul Cannings

The 1921 Institute

Co-founder

Ben Duster

Cormorant IV Corporation, LLC

Board of Directors

Steve Gray

The 1921 Institute

Co-founder

Karen Kerr

Exposition Ventures

Board of Directors

Greg McCray

PBE Axell

Board of Directors

Elizabeth P. Munson

Rockefeller Capital Management

Board of Directors

Mark Walsh

Ruxton Ventures

Board of Directors

Dr. Frazier Wilson

Shell USA, Inc.

Board of Directors

Kristi Craig

National Geographic Society

Advisory Board Member

Jeff Johnson

B Capital

Advisory Board Member

Nikki Kraus, CFA

Strategic Investment Group

Advisory Board Member

Michelle Morris

Morgan Stanley

Advisory Board Member

Bola Olusanya

The Nature Conservancy

Advisory Board Member

Carmen Palafox

MiLA Capital

University of Southern California

Advisory Board Member

Byron Pope

ChampionX Corporation

Advisory Board Member

Stephen West

Stepstone Group

Advisory Board Member

Dr. Ann Ziker

The Brown Foundation, Inc.

Advisory Board Member

A Look Back to Build Forward…

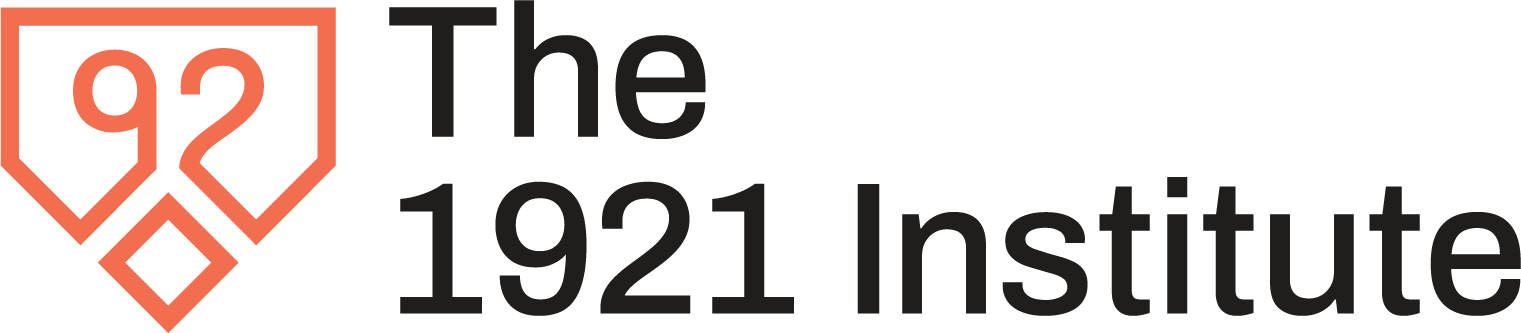

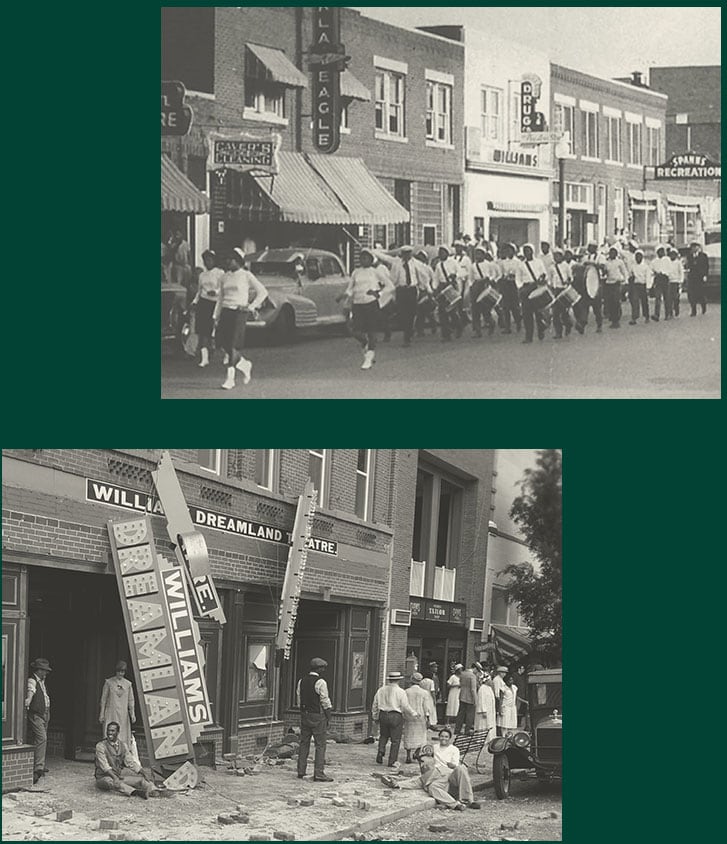

The 1921 Greenwood Race Massacre of Tulsa, OK, is one of the most tragic events in America’s history. Once receiving national recognition, Tulsa was home to the affluent and prestigious Greenwood District.

Often referred to as the “Black Wall Street,” Greenwood flourished with prosperous Black-owned businesses and thriving residential and commercial development. Fires, looting, bombing and rioting violently ravaged over 35 city blocks of Greenwood, and history reports more than 800 injuries with upwards of 300 fatalities.

The massacre resulted in a century of national economic deterioration for Blacks, including declines in land ownership, occupational ascension, and sustainability of Black entrepreneurship.